The smart Trick of Debt Consolidation Loans That Nobody is Discussing

Wiki Article

Debt Consolidation Loans for Beginners

Table of Contents7 Easy Facts About Funding Hub Described9 Simple Techniques For Personal Loan For Debt ConsolidationThe Ultimate Guide To Consolidation Personal LoansA Biased View of Bad Credit LoansThe 7-Second Trick For Personal Loan For Debt Consolidation

The qualification for an individual financing depends upon variables such as employment as well as credit report, settlement ability, earnings degree, etc. Get a personal financing is not just very easy however also a recommended option, owing to reasons like much less paperwork as well as the fact that there is no requirement for security to obtain it.This, subsequently, can decrease your chances of obtaining a personal car loan in the future. https://www.pubpub.org/user/james-buchanan. You require to keep in mind that the rate of interest on individual lendings are much greater than those on other kinds of car loans. This snowballing result of the interest prices is simply since these collateral-free lendings are approved to the customers without any assurance.

The lending institutions on their part will certainly neither monitor nor limit the end-use of the obtained funds. This can be useful for people to aid the difficult times that were prompted by the pandemic. The Covid-19 pandemic also catapulted the popularity of individual loans causing an excess of personal financing options readily available in the market today.

The Buzz on Small Business Loans

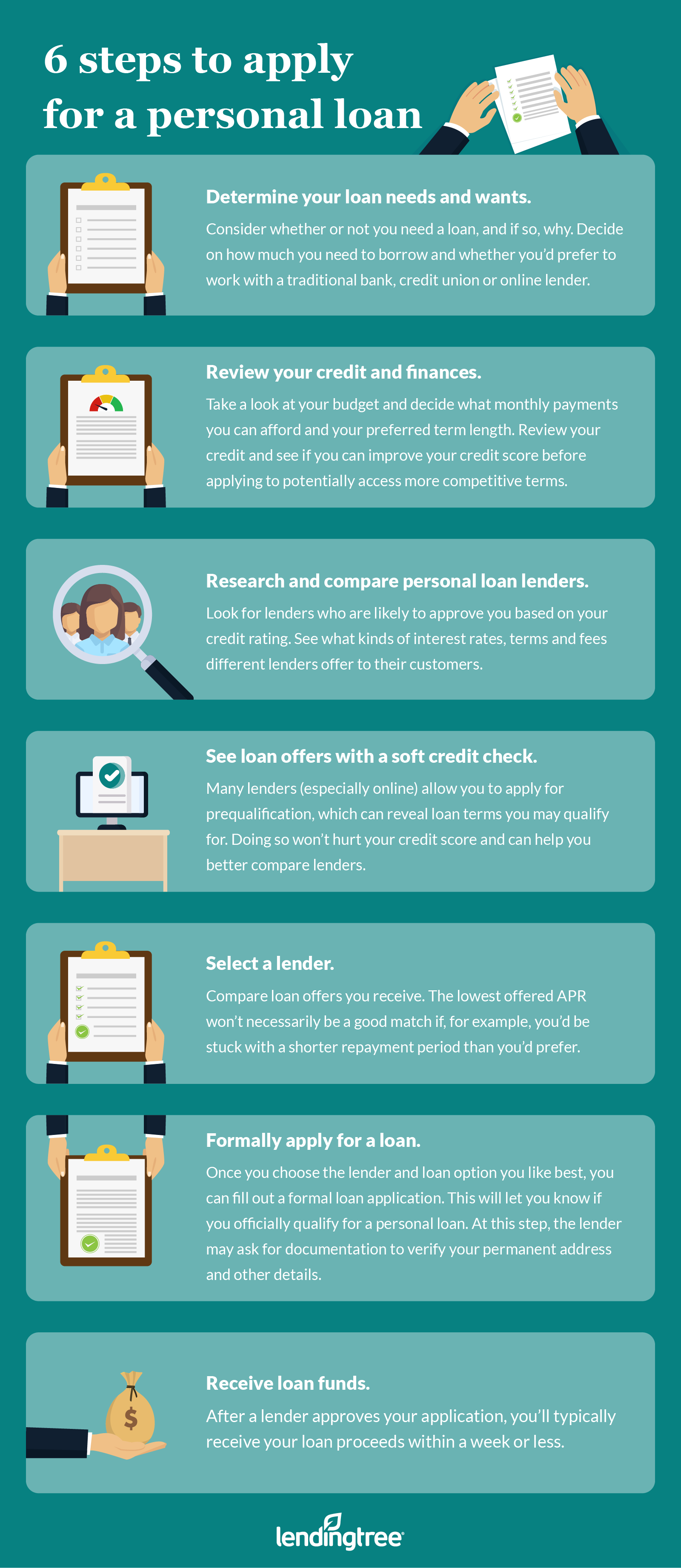

Below are the main points that you need to take into consideration: Before acting on your decision to get of an individual lending, among the most crucial factors entails making a decision the car loan amount that you desire to borrow. Relying on the need for funds, it is very important that you take care of the preferred financing quantity and then continue to compute the equated regular monthly installation (EMI) obligations based on the lending quantity as well as the period for which you take the lending.

When you take a lending, it is encouraged that you settle the lending at the earliest feasible time. That stated, lenders that supply a short period for payment would normally demand higher EMIs, owing to the lower variety of installations. bad credit loans. Back-pedaling financing settlement can leave a poor mark on your credit report, dissuading lenders from approving fundings to you in the future.

7 Simple Techniques For Debt Consolidation Loans

To make an informed decision, using an online collector system would certainly be the most effective option. You can compare pop over here the different lenders, their terms, as well as rates of interest and also you will even be alerted of the offers that these different lenders offer every now and then, on such platforms. If you're trying to find a long-lasting finance then you can take into consideration going with a well established bank that is using beneficial terms.

Prior to you take the action to get a personal car loan, it is very important that you check your credit scores or CIBIL score. While a greater rating will certainly increase your possibilities of obtaining a personal finance accepted the credit rating also has an impact on the funding quantity that is approved, consisting of the finance terms such as passion price and also EMIs.

Some Known Details About Small Business Loans

A credit history that is over 750 is thought about a good rating to get an individual financing sanctioned on beneficial terms. Funding Hub. You might have a myriad of lenders approach you with remarkable as well as partially low-interest prices. As attractive as this deal could be, bear in mind that when you choose such reduced interest-rate loans, you may wind up paying a lot more due to numerous other unreasonable funding terms.One more variable that you need to remember is how the passion prices are calculated (https://www.craigsdirectory.com/author/fundinghubb/). Car loan rate of interest that are determined utilizing a decreasing equilibrium approach are thought about to be optimal in many situations. Prior to you take a finance, it is vital that you obtain accustomed to the process of EMI estimation.

With choices like no-cost EMI and advanced EMI in the market, having a clear understanding of exactly how these EMIs are computed is very important to guarantee that you prevent paying greater than you need to. Some loan providers bill origination costs for personal financings. The source charge is a fixed amount that requires to be paid when the financing application is sent out to the lending institution or when the lending application has been confirmed.

The Personal Loan For Debt Consolidation Diaries

Another collection of costs that you require to be careful of is the foreclosure and also prepayment costs. These are fees that enter into the image if the debtor plans to resolve their lending before their financing period. While some banks might choose not to charge any kind of foreclosure costs, many financial institutions charge anywhere in between 2% and 5% of the equilibrium quantity.Besides the fees mentioned above, ensure that you do a comprehensive check of the loan terms for any type of various other charges such as administrative fees, lending processing costs, etc. Search for these costs on the lender's site or on their finance application. Being well mindful of all these added fees and fees will certainly help you know just just how much you will be charged in the procedure of taking a personal financing.

There may be instances when you already have a continuous loan that needs to be paid back or charge card bills that need to be cleared up. It's vital to consider these obligations as well as compute your debt-to-income proportion. This will additionally assist you know if you have enough money to pay back the funding.

Report this wiki page